Release notes

This release includes the following updates:

Helix Admin Console

What's new

-

Added functionality to support transfers from program business accounts. Users with the appropriate UPM permission(s) enabled, can transfer funds from program business accounts to customer accounts.

Helix card

Fixes

-

Fixed an issue in card and account maintenance where required record numbers were not generated when 3DS was enabled for cardholders who had email and/or mobile information on file, causing incomplete linking of opt-in records. This update ensures all required record numbers are properly created and associated.

This release includes the following updates:

Helix Admin Console

What's new

Helix

-

The following real-time event replaced the listed deprecated Common Event:

Event Type Id Description Payload Type Replaces Event Type Id 3060050 Transaction Interest Payment Adjustment Customer Account Deposit Payload (200) 40000024

-

Updated the payload for the following realtime events:

Event Type Id Description New Payload Previous Payload 40000021 Backup Withholding Transaction Created Common Payload (1) 40000023 Interest Payment Transaction Created Common Payload (1)

Helix money movement

What's new

-

Added additional transaction mappings to support an upcoming enhancement of the BAI File.

This release includes the following updates:

Helix card

What's new

-

Visa has added a new valid decline response code for credit voucher and merchandise return authorization transactions:

Response Code Description 78 Blocked, first used or special condition—new cardholder not activated or card is temporarily blocked This update enables merchants to handle returns more accurately when a card is inactive or temporarily blocked, improving clarity for customers.

Fixes

-

Fixed an issue where realtime event 3060272 (Card Authorization - Authorization Settled) did not consistently generate all fields for Debit Card Withdrawal Authorization Payload (403). The event now returns all relevant settlement data.

Helix reporting

What's new

-

*NEW* Added the EffectiveDate field to the CardMessage view.

This release includes the following updates:

Helix Admin Console

What's new

-

Renamed the Debit Card transaction type group to Card to support both prepaid and debit cards.

-

*NEW* Enhanced the underlying framework that powers Helix Admin Console navigation components, including:

-

Side navigation menu

-

Program bar

-

Cognitive search

This update improves navigation consistency and performance, provides a scalable foundation for future features, and enables faster delivery of new functionality while maintaining a cohesive user experience.

-

Helix card

What's new

-

Added the following properties to the Card Modified Payload (1200):

Property Data Type Description expediteCard boolean Indicates whether the card shipping is expedited or standard `true` indicates expedited

bypassExpeditedCardFee boolean Indicates whether the expedited card fee is waived or assessed `true` indicates waived

This release includes the following updates:

Helix Admin Console

What's new

-

*NEW* Added functionality to support creation of backup withholding adjustment transactions.

-

Enhanced the underlying framework that powers Helix Admin Console navigation components, including:

-

Side navigation menu

-

Program bar

-

Cognitive search

This update improves navigation consistency and performance, provides a scalable foundation for future features, and enables faster delivery of new functionality while maintaining a cohesive user experience.

-

Helix card

What's new

-

Added the following merchant category codes (MCC):

MCC or SubTypeCode

Merchant Group

Description

3304 TRAVEL AirBaltic 3841 TRAVEL TributePortfolio 3842 TRAVEL MarriottExecutiveApartments 3843 TRAVEL Moxy 3844 TRAVEL ACHotels 3845 TRAVEL Bulgari 3846 TRAVEL TheLuxuryCollection 3847 TRAVEL JWMarriott 3848 TRAVEL Edition 3849 TRAVEL Minacia 3850 TRAVEL BreezbayHotelGroup 3851 TRAVEL CandeoHotels 3852 TRAVEL CoreGlobalManagementHotelsAndResorts 3853 TRAVEL GranbellHotelsAndResort For a complete listing of merchant category codes, see the Helix API documentation at: https://docs.helix.q2.com/docs/merchant-category-codes.

-

Updated the /customer/get endpoint to support Helix programs with customers who do not have a tax identification number. When a taxIdType and taxId are not provided, the customerId property is returned, ensuring Centrix DTS receives a unique customer identifier for all disputes.

Fixes

-

Fixed an issue where realtime event 3060272 (Card Authorization - Authorization Settled) did not consistently generate all fields for Debit Card Withdrawal Authorization Payload (403). The event now returns all relevant settlement data.

Helix reporting

What's new

-

As part of ongoing efforts to improve performance and operational efficiency, select legacy reports are being retired from Helix Admin reporting. This initiative aligns with our broader System of Record (SOR) database project, which focuses on migrating only actively used reports to our current platform. If you require access to a report that is no longer available, please contact your Helix Customer Success Manager (CSM) for assistance.

-

*NEW* To improve processing efficiency and enhance the stakeholder experience, statement generation has been updated.

Previously, customer statements were generated for any customer in a Verified status at any time during the statement period, regardless of account-level conditions.

Beginning with the October 2025 statement period, customer statements will be generated only when the program is active and at least one of the following account conditions is met:

-

The account is Open

-

The account is Closed within the statement period

-

The account is Closed with a balance at the end of the statement period

-

The account is Closed but has transaction activity within the statement period, regardless of the ending balance

-

This release includes the following updates:

Helix Admin Console

What's new

-

Updated logic to delay, reinitiate, and void ODFI ACH deposits in addition to ODFI ACH withdrawals on the following pages:

-

ACH Transaction List page (Core Services > {Customer Name} > Accounts > Transactions)

-

ACH Transaction Detail page (Core Services > {Customer Name} > Accounts > Transactions)

-

-

Updated logic to verify delayed, reinitiated, and voided ODFI ACH deposits in addition to ODFI ACH withdrawals in the Delayed ACH Queue (Core Services > Manual Review > Delayed ACH Queue)

Helix card

What's new

-

Added the following realtime events to provide awareness when a customer record is created:

Event Type Id Description Payload Type Detail 49006003 Create Customer Customer record is created using /customer/create 49006004

Create Business Customer

Customer record is created using /customer/createBusiness

-

*NEW* Added the following property to the In Auth Payload:

Property Data Type Description AVSResult string Address Verification Service (AVS) verifies that the address entered by the customer is associated with the cardholder’s account. -

Fixed an issue where the merchantCategoryCode property was incorrectly populated as a null value instead of the following:

MCC or SubTypeCode Merchant Group Description 6011 CASH FinancialInstitutionsAutomatedCashDisbursements

Helix money movement

Fixes

-

Fixed an issue where wires approved after the cutoff on a holiday caused file creation to fail. Now, wires approved after 6:00 PM CT will automatically have the interbank settlement date set to the next business day in the wire file.

Note: Settlement within Helix remains immediate. To avoid confusion, we recommend approving wires only on the banking day they are intended to process.

This release includes the following updates:

Helix card

What's new

-

Added the following fields to PAN display templates:

-

Available Balance

-

ZIP Code

These fields increase flexibility and control over card display templates, while supporting compliance and verification use cases.

-

-

*NEW* To improve compliance, fraud mitigation, and customer service through more structured event data, the following real-time events replace the listed deprecated Common Events:

Event Type Id Description Payload Type Detail Replaces Event Type Id 49006000 Modified Customer Residential Address Modified Customer Address Payload (1900) Change to customer residential address occurred on customer account 3023

49006001 Modified Customer Mailing Address Modified Customer Address Payload (1900) Change to customer mailing address occurred on customer account 3024

49006002 Modified Customer Contact Information Change to customer contact information occurred on customer account 3022

Fixes

-

Fixed an issue where realtime event 3061001 (International Card Fee) was not generated consistently for all international transactions.

Helix money movement

What's new

-

Updated logic to support delayed ODFI ACH deposits in addition to ODFI ACH withdrawals:

-

Updated the /transaction/setStatus endpoint to allow status changes on ODFI Deposits for the following transaction types:

Code

Description

ACHDEP ACH Originated Helix Deposit CPBDEP Helix Deposit (Business account) CPDEP Helix Deposit (Consumer account) RCRBDP Helix Recurring Deposit RCRDEP Recurring deposit into a Customer Account -

Updated the following Transaction Modified Events to generate for ODFI Deposits:

Event Type Id

Description

Payload Type

40000014 ACH Originated Helix Deposit 40000015 Helix Deposit (Business account) 40000016 Helix Deposit (Consumer account) -

Updated the following error message:

Code

New Message

Previous Message

191404 Transaction cannot be updated because TransactionType is not an ODFI ACH Withdrawals or Deposits. Transaction cannot be updated because TransactionType is not CPWTH-Withdrawals

-

This release includes the following updates:

Helix Admin Console

What's new

-

*NEW* Updated logic to support automated decisioning on the Card Usage Analysis page (Core Services > {Customer Name} > Card > Recent Card Activity > Card Usage Analysis > Card Activity Details), including:

-

More detailed reasons on the Auth Type and In Auth reason fields

-

Helix card

What's new

-

Added the following in-auth decision mapping endpoints:

-

/program/getInAuthReasonCodeMap

-

/program/createInAuthReasonCodeMap

-

/program/updateInAuthReasonCodeMap

-

Fixes

-

Fixed an issue where both realtime events 40003001 (Card Renewed) and 49004001 (Card Reissued With New PAN) were generated when reissuing a card via /card/reissue. Now, 40003001 is generated only for card renewals, while all other reasons continue to generate 49004001.

Helix money movement

What's new

-

Updated the Bulk Transfer Process to support posting to closed accounts for archived customers, ensuring proper handling of returned funds without manual intervention..

Fixes

-

Fixed an issue where some ACH transactions did not correctly display return information if a related account holder (such as a joint or business account owner) initiated the return. The logic has been updated to properly associate return data regardless of which customer initiates the return, ensuring that only one return can be processed for each original transaction.

-

Fixed an issue where some check transactions did not correctly display return information if a related account holder (such as a joint or business account owner) initiated the return. The logic has been updated to properly associate return data regardless of which customer initiates the return, ensuring that only one return can be processed for each original transaction.

This release includes the following updates:

Helix Admin Console

What's new

-

Redesigned the Unauthorized Trans section of the Manual Review queue (Core Services > Manual Review > Unauthorized Trans). The review process is now streamlined by removing irrelevant fields and highlighting essential transaction/return details, improving operational efficiency, accuracy, and resolution speed.

Section

Update

Customer Added Date Created (customer record creation date) Account Added Product Name and Account ID External Account Removed; relevant fields moved to Transaction section Removed fields:

Account Number

Tag

Nacha Account Number

Created Date

Category

NACHA Amount (already shown in Transaction section)

Renamed fields:

Nacha Company Name → Individual Name

Nacha Routing Number → Company Identification

Transaction Added fields (from ACH Transaction Detail screen): Trace Number

Company Name

Company Entry Description

Company Discretionary Data

Transaction Code

Transaction ID

Removed field:

Created Date

Renamed field:

Settled Date → Settled Date & Time

Return Information (New) Added fields: Return Code Selected

User Who Initiated the Return (first and last name)

Email Address of User Who Initiated the Return

Return Initiation Date/Time

-

Combined the Authorization Revoked and Unauthorized Trans manual review queues into a single queue renamed ACH Unauthorized. This queue will handle the following ACH return codes that require a Written Statement of Unauthorized Debit (WSUD):

-

R05 - Unauthorized Debit to Consumer Account Using Corporate SEC Code

-

R07 - Customer Revoked Authorization

-

R10 - Originator not known and/or not authorized to Debit Receiver’s Account

-

R11 - Check Truncation Entry Return (used when a consumer claims a problem with a check conversion)

-

R37 - Source Document Presented for Payment

-

R51 - Item Related to RCK Entry Is Ineligible or RCK Entry Is Improper

-

R53 - Item and RCK Entry Presented for Payment

-

Helix card

What's new

-

*NEW* Added the following Card Modified realtime events to notify customers when cards are reissued:

Event Type Id Description Payload Type Detail 49004000 Card Reissued With Existing PAN Card Modified Payload (1200) A card has been issued with an existing PAN (primary account number) 49004001 Card Reissued With New PAN Card Modified Payload (1200) A card has been issued with a new PAN (primary account number)

-

*NEW* Added the following path parameter to the /card/pandisplaytoken endpoint:

Parameter Required Description bypassIpValidation No When true, the system bypasses the usual IP address validation between the mobile device (endUserDeviceIP) and the request source (requestIPAddress). This allows mobile users who may experience IP switching during transit—such as moving between Wi-Fi and cellular networks—which can otherwise disrupt PAN display functionality.

Fixes

-

Removed logic that applied the ABS (absolute value) function to AdditionalAmounts values in realtime events. Values such as cashbackAmount, cashDepositAmount, and checkDepositAmount now retain their true positive or negative values, matching the In Auth Payload and Debit Card Event Notification File. This change preserves transaction accuracy and prevents misreporting.

Helix money movement

Fixes

-

Updated the logic for generating the Posted Transaction File to normalize invalid account ID values for the following transaction types:

Transaction type Property Previous value New value CTCRD Credit Account ID -1 0 CTDBT Debit Account ID -1 0 Normalizing these values to 0 improves data clarity and ensures consistent interpretation of account IDs.

This release includes the following updates:

Helix Admin Console

What's new

-

Added functionality to send funds to the following accounts when closing accounts via Helix Admin Console:

-

Program reserve account

-

Program clearing account

This is in addition to the following existing routing option:

-

Petty cash program account

-

Fixes

-

Fixed issues affecting the ACH Return process from the ACH Detail page for certain return codes:

-

For R17 return codes, the Addenda Information field appears on the initial screen of the return, allowing users to enter free-form text without proceeding to the review step

-

For R14 and R15 return codes, the Date of Death calendar input displays immediately when the code is selected, no longer requiring the user to proceed to the review step

-

Helix card

What's new

-

*NEW* Added the following property to the card object:

Property Data Type (length) Description isPinSet boolean Indicates whether a PIN has been set on a debit card This property is returned for the following endpoints:

Fixes

-

*NEW* Fixed an issue where clients may have received duplicate alerts for the following event during transaction processing:

Event Type Id Description Detail Payload 3060351 Card Deposit - Merchandise Return Return of goods or services Debit Card Deposit Payload (400) Alerts for this event are now initiated and delivered only once per qualifying transaction.

-

*NEW* Fixed an issue where cross-border transaction balances were returned to Visa DPS in the foreign currency instead of U.S. dollars (USD). Balances are now consistently returned in USD.

-

*NEW* Fixed an issue an issue where single authorizations with multiple completions incorrectly released the full hold after the first settlement. Holds now decrement correctly with each completion.

Helix core

What's new

-

*NEW* Updated the following realtime event to indicate when a demographic lock is removed and related accounts are systematically unlocked:

Event Type Id Description Payload 12002 Account unlocked by Admin Common Payload (1)

Helix reporting

What's new

-

Updated the following on the Wire Exception report:

-

Added a Customer Name column which displays the first name listed on the intended recipient's account in "First Last" format. For business accounts, the business name will be shown instead.

-

Updated the report filter to have every exception type selected by default

-

Reordered columns in the report to organize related information together for improved usability

This report can be found under the Wires heading in the Reports section of Helix Admin Console.

-

Helix money movement

What's new

-

Added the wireInfo property to the transaction object to be returned for the /transaction/get and /transaction/list endpoints. This property contains a wireInfo object containing additional data for wire transactions.

This release includes the following updates:

Helix Admin Console

What's new

-

Fixed an issue where some warnings were not displayed when posting wire deposits.

Helix card

What's new

-

*NEW* Updated the Card Transaction File to exclude international card fee transaction records. These records will continue to be included in the Posted Transaction File.

Helix core

What's new

-

Added functionality to control whether accounts are kept on the balance sheet or routed to a specific deposit network based on their product. Deposit network jobs now require a depositNetworkTypeId, ensuring only accounts from the configured product are included.

Helix money movement

What's new

-

*NEW* Added functionality to send funds to the following accounts when closing accounts via /account/close or Bulk Account Close Process:

-

Program reserve account

-

Program clearing account

This is in addition to the following existing routing options:

-

Internal account under same Customer ID

-

External account

-

Program suspense account

-

This release includes the following updates:

Helix Admin Console

Fixes

-

Fixed an issue where some warnings were not displayed when posting ACH debits or credits.

-

*NEW* Fixed an issue where some warnings were not displayed when posting check withdrawals.

Helix card

Access is limited to users with the Can View Customer Security Questions or Can Edit Customer Security Questions permission in the Helix Admin Console.

What's new

-

Added a Customer Security Questions pane to the Demographic page (Core Services > {Customer Name} > Demographic) to enhance verification and support password recovery.

This release includes the following updates:

Helix Admin Console

What's new

-

Effective July 1, 2025, the NYCE Payment Network will increase the purchase pre-authorization amount for Automated Fuel Dispensers (MCC 5542) from $150 to $175 to align with industry standards.

-

*NEW* Added the following property to the due diligence question object to be returned for the /program/questionsList endpoint:

-

questionOrder

-

Helix card

What's new

- Added the /customer/securityanswerslist endpoint to retrieve a customer’s security answers in a specified language (default: English US). Supports multilingual answers if enabled.

- Added the /customer/securityanswerspost endpoint to create, update, or deactivate a customer’s security answers. Supports multilingual answers if enabled.

- Added the /program/securityquestionslist endpoint retrieve program security questions in a specified language (default: English US). Supports multilingual questions if enabled by the program.

This release includes the following updates:

Helix card

What's new

-

Updated the /card/limit/get endpoint to accommodate bank ceiling limits at the program level.

-

Added the following path parameter to the /card/provision/cardDetail endpoint:

-

walletType

This allows clients to specify whether the request is for Apple Pay or Google Pay.

-

This release includes the following updates:

Helix Admin Console

What's new

-

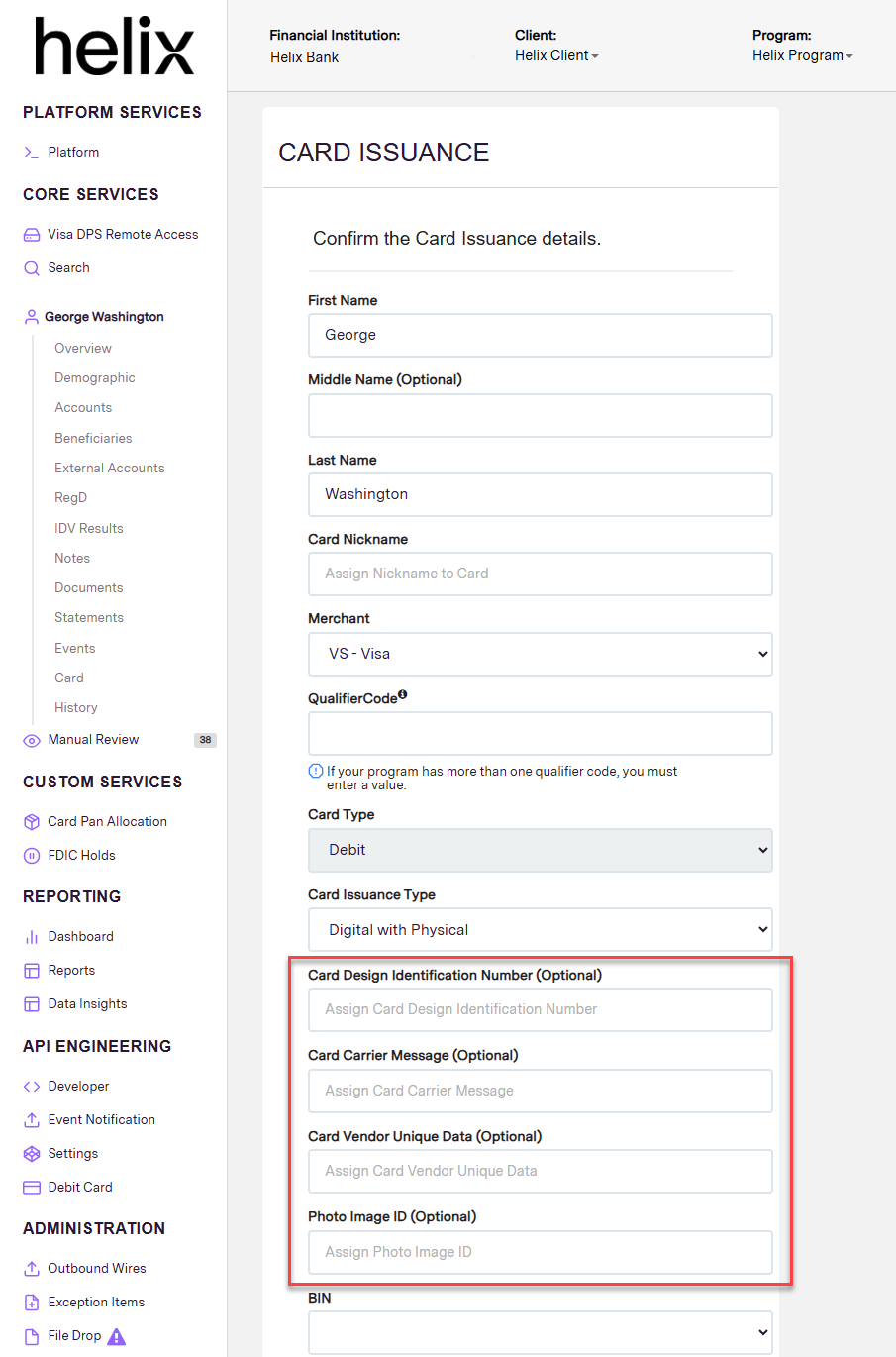

Added the following fields to the Card Issuance page (Core Services > {Customer Name} > Accounts > Overview > Management Tools > Debit Card > Issue Card):

-

Photo Image Id (Optional)

-

Card Design Identification Number (Optional)

-

Card Carrier Message (Optional)

-

Card Vendor Unique Data (Optional)

These optional fields allow clients with specific card personalization needs to send the proper data to their card manufacturer.

-

-

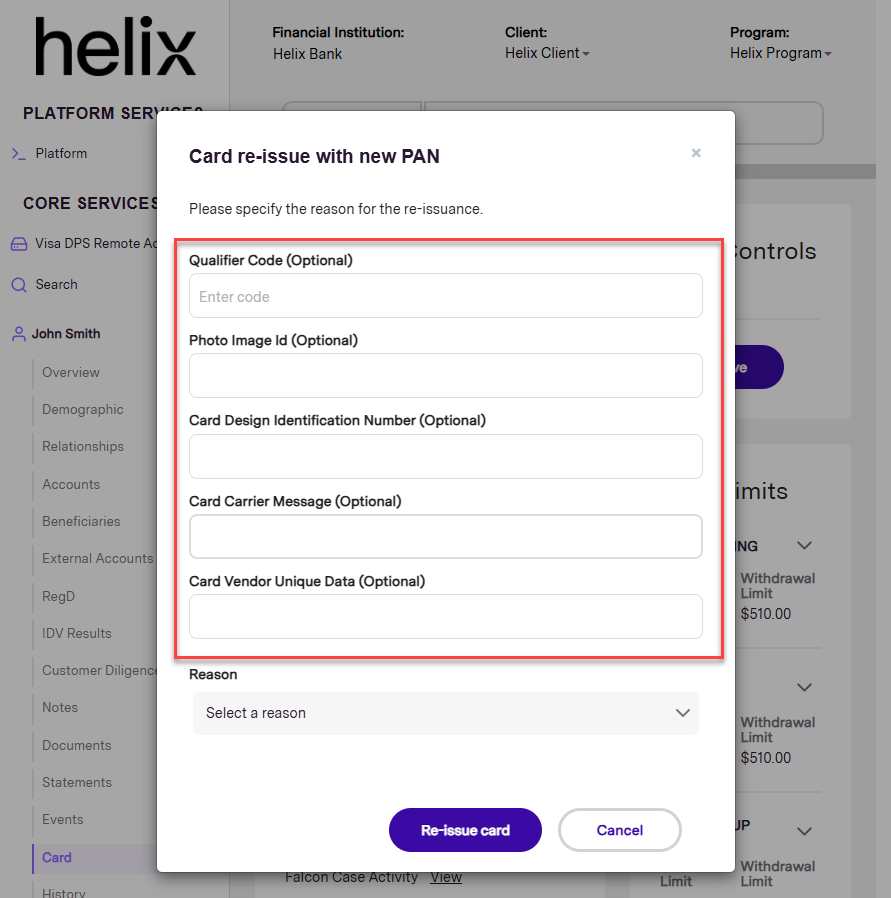

Added the following fields to the Card re-issue with new PAN dialog box (Core Services > {Customer Name} > Card > Card List > {Card ID} > Card Management > Actions > Re-issue with new PAN):

-

Photo Image Id (Optional)

-

Card Design Identification Number (Optional)

-

Card Carrier Message (Optional)

-

Card Vendor Unique Data (Optional)

These optional fields allow clients with specific card personalization needs to send the proper data to their card manufacturer.

-

Helix card

What's new

-

Added the following body parameters to the /card/update endpoint:

-

expireMonth

-

expireYear

This will allow clients to stage cards in the sandbox environment for testing of card renewals and expirations.

-

-

*NEW* Added the optional cardHolderCustomerId query parameter to the following endpoints:

This allows clients to retrieve information for minors and business customers.

Helix reporting

What's new

The following update applies only to bank users.

*NEW* Updated the Trial Balance File to reflect manual interest adjustments in the following columns:

Period Interest Paid

Year To Date Interest Paid

This release includes the following updates:

Helix Admin Console

What's new

-

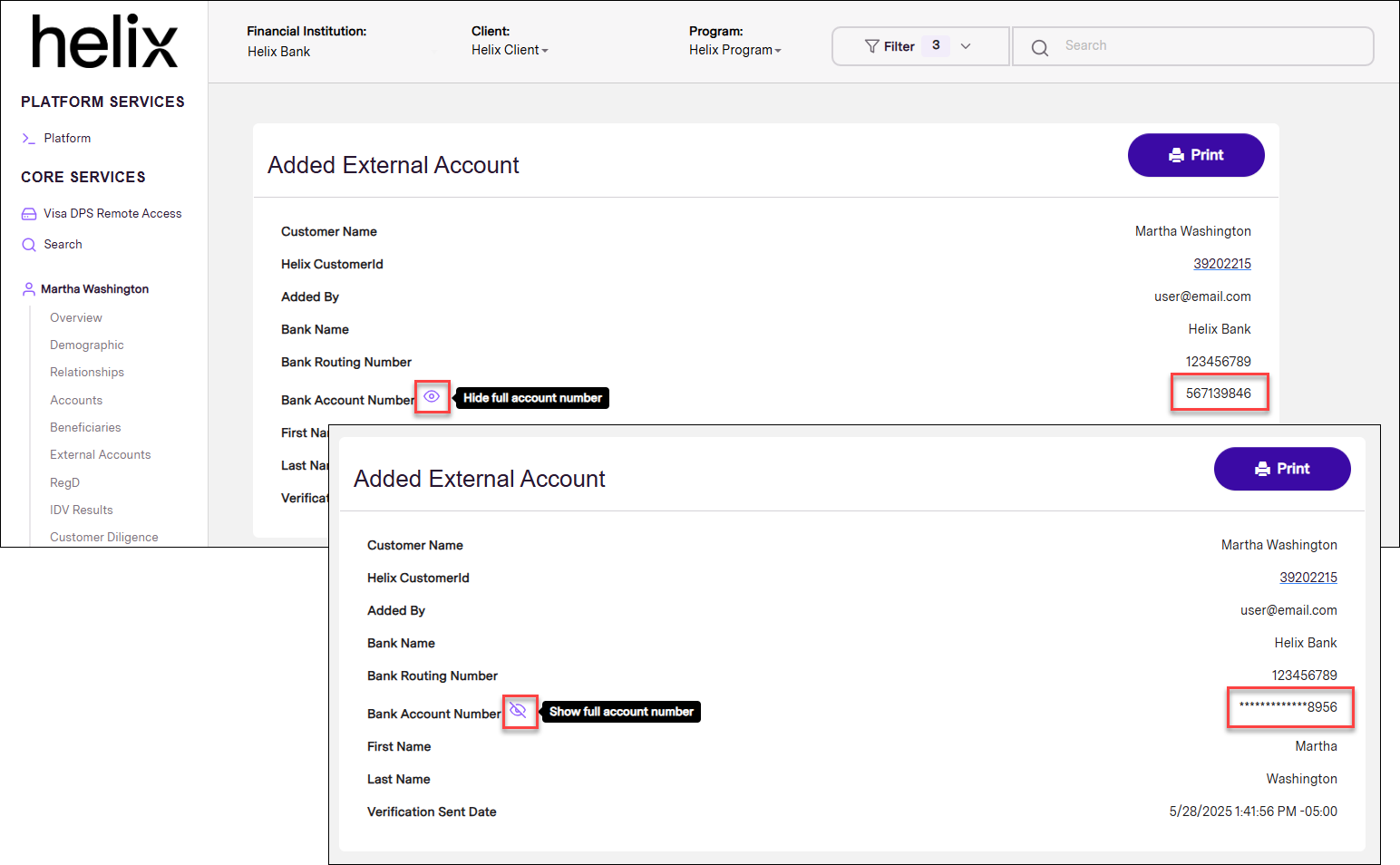

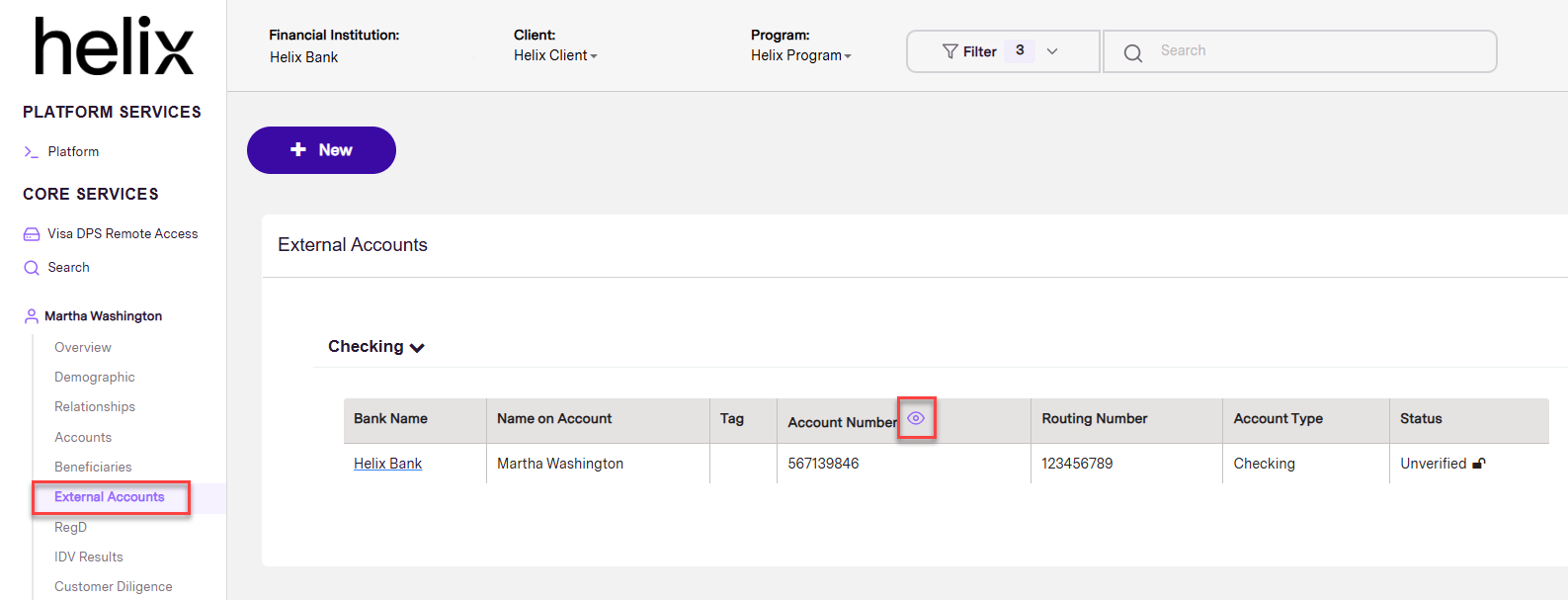

*NEW* Added the following User Permission Manager (UPM) permission on the User Detail page, allowing administrators to view the External Account Number.

Permission

Function

Actions

Can View External Account Numbers Users with this permission can view unmasked external account numbers for customers in Helix Admin Console

Default is

(masked).

(masked).

Select to display full, unmasked account number.

to display full, unmasked account number.

Select to mask all but the last four digits.

to mask all but the last four digits.

Helix card

What's new

-

Updated the /card/verify endpoint with the following:

-

Added a restriction that prevents activation of the card if the card was created on the same day the activation is attempted. This applies to all physical cards, including dual issuance single PAN cards.

-

Added the following error message:

153008 CardId {0} cannot be verified since it has not been sent to manufacturer yet. -

Fixes

-

Fixed an issue where dk (RSM Rule ID) was not present in all declined events. This property should be present in all declined card transaction events if the decline occurs as a result of a Risk Services Manager (RSM) rule.

Helix money movement

What's new

-

*NEW* Updated the /transfer/create endpoint to support transfers between program reserve accounts.

Fixes

-

Fixed an issue where check images were not returned with the /transaction/get endpoint.

Helix reporting

Fixes

-

Added the following values to the Return Reasons search filter on the Initiated Transactions report:

0: NA

1: NONCOMPLIANT TIFF

2: NA

3: Warranty Breach (Includes Rule 8 & 9 claims)

4: RCC Warranty Breach (Rule 8)

5: Forged and Counterfeit Warranty Breach (Rule 9)

6: Retired/Ineligible/Failed Institution Routing Number

7: Reserved for Future Use by X9

8: Reserved for Future Use by X9

9: Reserved for Future Use by X9

A: NSF - Not Sufficient Funds

B: UCF - Uncollected Funds Hold

C: Stop Payment

D: Closed Account

E: UTLA - Unable to Locate Account

F: Frozen/Blocked Account–Account has Restrictions placed on it by either customer or bank

G: Stale Dated

H: Post Dated

I: Endorsement Missing

J: Endorsement Irregular

K: Signature(s) Missing

L: Signature(s) Irregular, Suspected Forgery

M: Non-Cash Item (Non-Negotiable)

N: Altered/Fictitious Item/Suspected Counterfeit/Counterfeit

O: Unable to Process (e.g. Unable to process physical item/Mutilated such that critical payment info is unreadable)

P: Item Exceeds Stated Max Value

Q: Not Authorized (Includes Drafts)–Unauthorized item such as a draft

R: Branch/Account Sold (Wrong Bank)–Divested Account, Not Our Item

S: Refer to Maker

T: Item cannot be re-presented (Exceeds number of allowable times the item can be presented)

U: Unusable Image (Image could not be used for required business purpose, e.g. gross image defects)

V: IMAGE FAILS SECURITY

W: Cannot Determine Amount–Amount cannot be verified

X: Refer to Image–Return Reason information is contained within the image of the item

Y: Duplicate Presentment (Supporting documentation shall be readily available)

Z: Forgery–An affidavit shall be available upon request

This report can be found under the ACH heading in the Reports section of Helix Admin Console.

-

Fixed the following on the Incoming Wires report:

-

Updated the Originating Bank Country Code column to Address Line 2

-

Updated the Address Line 2 font color from white to black

This report can be found under the Wires heading in the Reports section of Helix Admin Console.

-